Bitcoin price forecast

Recently bitcoins have become more popular due to a huge price spike(and vice versa). Since they’re all the rage right now, I thought it would be a neat idea to do a brief time-series forecast of the Bitcoin’s price here on my site. For now, I will just leave this simple version, but later I may revisit this post and add more time-series content to it.

Recently bitcoins have become more popular due to a huge price spike(and vice versa). Since they’re all the rage right now, I thought it would be a neat idea to do a brief time-series forecast of the Bitcoin’s price here on my site. For now, I will just leave this simple version, but later I may revisit this post and add more time-series content to it.

Let’s start with the autocorrelation function plot of the price series. This is analyzed to determine the properties of the process. If too many lags are correlated, the model may not be stationary(a mean-reverting process whose underlying statistical properties do not change). In this case, the model is not stationary, like many financial time series.

In the event of non-stationarity, the model must be differenced(xt-xt-1). This is the acf of the first difference of the series. Notice the statistically significant autocorrelations at lags 1 and 2. 0) model will be fit.

0) model will be fit.

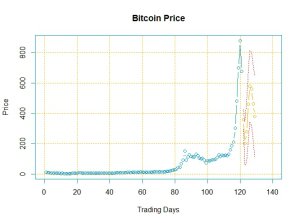

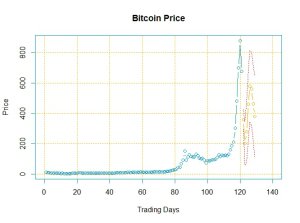

This is a plot of the price with the forecasted prices and +- 2 standard error bands.

This is the actual vector of forecasted prices – 8 days ahead

[1] 356.9018 200.2613 277.0625 460.0757 578.4875 560.9901 460.8999 378.8422

Here is the ACF plot of the residuals. The lack of autocorrelation is an indicator that the model is explaining the process to its full potential and is a good fit.

Lastly, here is the code that produced the model.

Price