Bitcoin crash 2013

While we are used to seeing insta-crashes in our highly-regulated and trustworthy equity markets, the unregulated digital world of Bitcoins suffered another flash-crash last night. According to Ars Technica, the 23% plungefest in the value of the digital currency (the second in a week) was due not to Waddel & Reed, not HFT algos, but 'forking' Cryptographic algos gone wild agreeing on different (legacy) keys as being correct - akin to finding Tungsten in your Gold bars (and hence the drop in the value). This latest glitch is different from the problem that caused Bitcoin prices to briefly crash to zero in June of 2011.

While we are used to seeing insta-crashes in our highly-regulated and trustworthy equity markets, the unregulated digital world of Bitcoins suffered another flash-crash last night. According to Ars Technica, the 23% plungefest in the value of the digital currency (the second in a week) was due not to Waddel & Reed, not HFT algos, but 'forking' Cryptographic algos gone wild agreeing on different (legacy) keys as being correct - akin to finding Tungsten in your Gold bars (and hence the drop in the value). This latest glitch is different from the problem that caused Bitcoin prices to briefly crash to zero in June of 2011. l-off was caused by the compromise of the exchange itself, whereas this time the glitch occurred in the core Bitcoin software. Obviously, the incident will be another important test of the cryptocurrency's decentralized governance structure - to say nothing of its reputation among the less technically-capable owners and miners (even though BTC rapidly recovered almost all its losses).

l-off was caused by the compromise of the exchange itself, whereas this time the glitch occurred in the core Bitcoin software. Obviously, the incident will be another important test of the cryptocurrency's decentralized governance structure - to say nothing of its reputation among the less technically-capable owners and miners (even though BTC rapidly recovered almost all its losses).

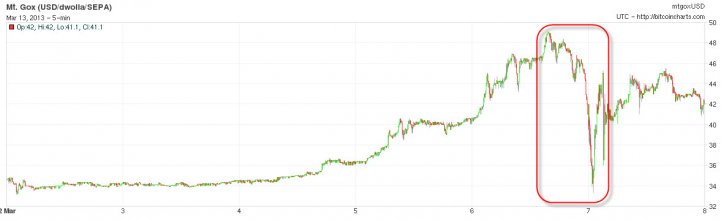

Last night's bitcoin software-related crash...

and last week's 'market' based crash

and the life of BTC...

From a high of more than $48 earlier Monday, the value of Bitcoins plummeted to less than $37 around 10 PM Central time on Monday evening, a 23 percent decline. The price has since recovered; one Bitcoin is now worth about $46 - which, one could argue reflects a rapid recoupling with value and confidence (especially given the recent run-up in price) but notably, flash-crashes in equities (as we noted above) never seemed to stop greed-stricken investors piling into them anyway.

"I lost $50,000 in Bitcoin crash, but I'm still a believer"

"I lost $50,000 in Bitcoin crash, but I'm still a believer"