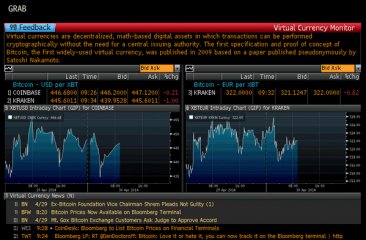

Bitcoin Bloomberg

Bloomberg has started providing bitcoin pricing to more than 320, 000 subscribers via its Bloomberg Professional service.

All users need to do to access the new service is type VCCY on the Bloomberg Professional service.

Bloomberg was rumoured to be working on a bitcoin price ticker last August. At the time an inside source told BTCGeek that Bloomberg employees could access the new feature on their Bloomberg terminal and look up bitcoin pricing.

Mixed reactions

The Wall Street Journal described Bloomberg’s decision to start providing bitcoin pricing as a “key stamp of approval” and the move will surely be welcomed by many in the bitcoin community. However, Bloomberg has pointed out that opinions on bitcoin are mixed:

“Everyone from Warren Buffett and Marc Andreessen to the Winklevoss twins and the Internal Revenue Service has opined on the viability of the digital currency. Depending on your vantage point, bitcoin may be the biggest technology innovation since the Internet or a fad whose crash will be as precipitous as its meteoric rise.”

“It’s worth noting that we are not endorsing or guaranteeing bitcoin, and investors cannot trade bitcoin or other digital currencies on Bloomberg.”

Fostering innovation

Bloomberg said its decision to start providing information about a controversial market like bitcoin was prompted by several reasons. The company believes it can offer better transparency and it can help foster innovation.

“While bitcoin and other virtual currency markets are still nascent, they represent an interesting intersection of finance and technology. Given that Bloomberg sits squarely at that intersection, providing pricing for this underdeveloped market is a natural fit for us, ” Bloomberg pointed out.

Lastly, Bloomberg said it is merely responding to client demand. Bloomberg clients are increasingly interested in bitcoin and other digital currencies, so they need tools to better monitor developments in these emerging markets.

Bloomberg included a number of caveats in its announcement, saying that interest in global currencies is going up, but they still represent just a fraction of global fiat currency usage. The company also pointed out that reaction from governments has been mixed and the regulatory environment remains unclear.

"Bloomberg TV Anchor's Bitcoin Stolen On Primetime TV"

"Bloomberg TV Anchor's Bitcoin Stolen On Primetime TV"