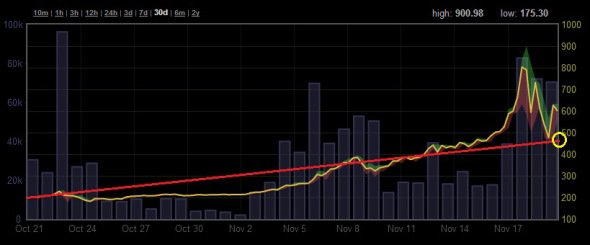

Bitcoin 30-Day

It’s been several months since I last posted anything about BitCoins but let’s be honest, they didn’t give me much reason to write anything. That is, until October rolled around and the new normal quickly went from a tepid range of $70-$120 per bitcoin (BTC) to a staggering $500-$800 range just over the last 7 days. How? Why??? The New Yorker wrote a good piece about it lately identifying the main culprit for the spike to be the newly minted monster exchange called BTC China which has overtaken the undisputed giant Mt. Gox in a short period of time. Piled on top of this is our own US Congress dictating that they are mulling over the use of BitCoins as a legal form of currency (as it isn’t already) and expand it’s use throughout the USA.

It’s been several months since I last posted anything about BitCoins but let’s be honest, they didn’t give me much reason to write anything. That is, until October rolled around and the new normal quickly went from a tepid range of $70-$120 per bitcoin (BTC) to a staggering $500-$800 range just over the last 7 days. How? Why??? The New Yorker wrote a good piece about it lately identifying the main culprit for the spike to be the newly minted monster exchange called BTC China which has overtaken the undisputed giant Mt. Gox in a short period of time. Piled on top of this is our own US Congress dictating that they are mulling over the use of BitCoins as a legal form of currency (as it isn’t already) and expand it’s use throughout the USA. gest but like any rapidly rising commodity/currency, there is always room for an equally rapid fall. Be cautious buying at these prices. Check out my charts below:

gest but like any rapidly rising commodity/currency, there is always room for an equally rapid fall. Be cautious buying at these prices. Check out my charts below:

Based on this chart, I would stay far away from buying BitCoins regardless of my intent of what I will do with it, chaos abounds.

This is a 30-day chart, notice the trendline would have only pegged each BTC at roughly over $450, this is where I think it should be even factoring in the sudden spike in demand from China after weeding out global speculation.

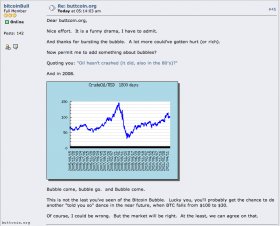

Now here is insanity. This chart is only using a 6 month time horizon but it already looks eerily similar to that of a penny stock that just got pumped up by a massive spam email campaign. This is the scariest chart to me telling me to stay out of this if you are a new bitcoin buyer. If you held on during the boring era, congrats! Sell on the hype and wait. Until next time.

The highly-renowned, oft-cited "Breath-of-Fresh-Air Alternative to Calamitous Fiat Paper"

The highly-renowned, oft-cited "Breath-of-Fresh-Air Alternative to Calamitous Fiat Paper"