How does bitcoin miner work

We’ve had several readers ask about Bitcoin. What is it? How do you get it? How does it work? So, since it’s been in the news increasingly lately, I figured I’d give you a quick crash course on how Bitcoin (BTC) and other cryptocurrencies work.

We’ve had several readers ask about Bitcoin. What is it? How do you get it? How does it work? So, since it’s been in the news increasingly lately, I figured I’d give you a quick crash course on how Bitcoin (BTC) and other cryptocurrencies work.

Bitcoin has somewhat of a mysterious past. It was started in 2009, but its unknown by whom. The person (or persons) go by the pseudonym Satoshi Nakamoto and have never made a public appearance on behalf of Bitcoin.

The idea behind Bitcoin: it’s a virtual currency that can be transferred to anyone, anywhere. It isn’t issued by any central bank like traditional forms of currency, and it can be bought and sold anonymously online. In that sense, the market for Bitcoin could be compared to stocks. It’s assigned a value based on demand, where buying and selling influences the price. the higher the price goes. The more Bitcoin is sold, the lower the price goes.

the higher the price goes. The more Bitcoin is sold, the lower the price goes.

Since Bitcoins aren’t issued by a bank in the traditional sense, the two ways to acquire it are to either buy BTC from other individuals who are selling it, or to mine it. Bitcoin mining and the science behind it is a different post for a different time. The long and short of it is this: the peer-to-peer network that makes Bitcoin run posts each buy / sell transaction back to a public log. The computers on the P2P network all work to verify the transactions through a series of complex algorithms and mathematic equations and once verified, the coins are allocated to that user.

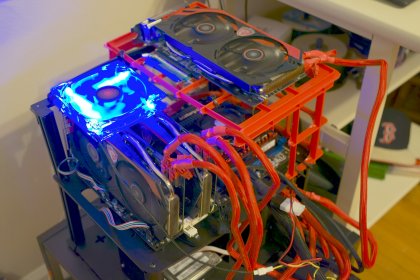

All the computational power required to run the Bitcoin network lead miners – that is, individuals specifically trying to earn Bitcoin – to build intensely powerful computers like the one pictured here.

Once a Bitcoin (or block of 25 Bitcoins) is earned, it’s “paid” out to the user. The coin is represented by an encrypted key, which can only be decrypted by a second key. The Economist explains in this example: